What is Wrong with The Economy & What Can I Do About It?

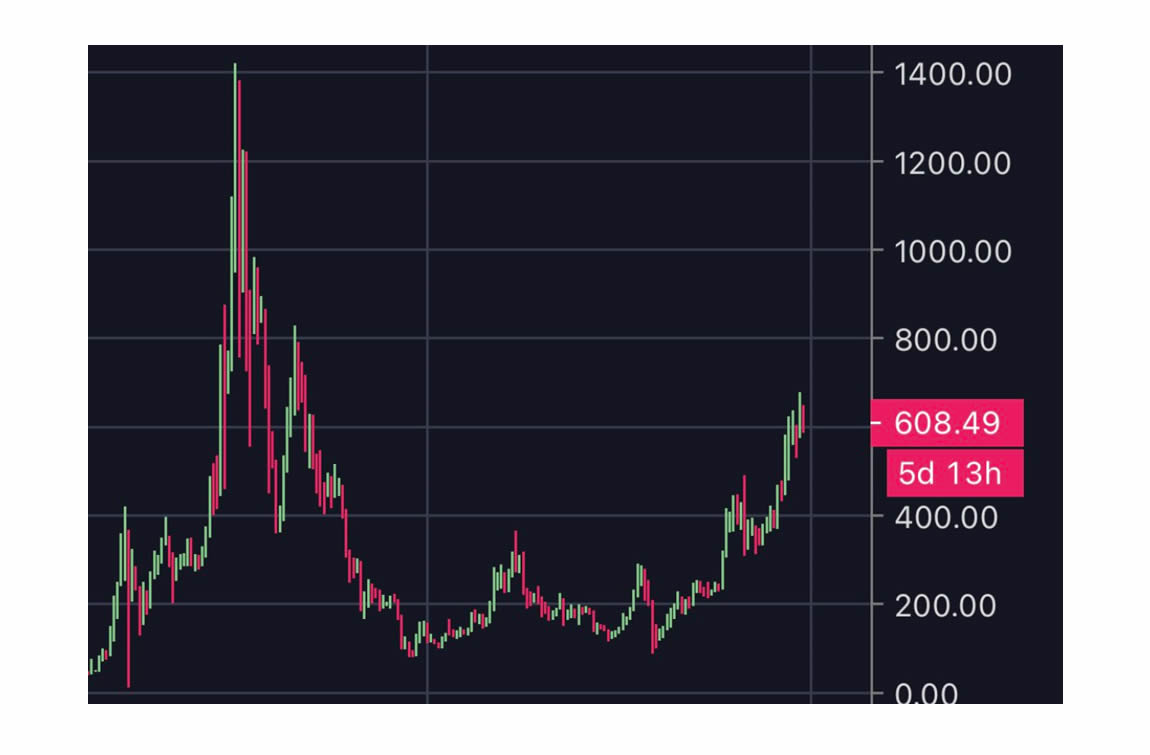

We are short on time today unfortunately. This short week is tough. Below is a chart on Ethereum. Neutral ATM looks at Bitcoin as the store of value (SOV), and Ethereum as the mode of exchange (MOE). Together, they replace a 60/40 portfolio. Throw in a little Gold, Silver, and fractional Fine Art from Masterworks. People need to under stand what Bitcoin is actually doing. Come to think of it, Ethereum is matching Bitcoin but for different reasons. Visa is using the Ethereum platform to offer crypto currency as a mode of exchange, via Visa. Mass Mutual, Prudential, Fidelity, JP Morgan, and many public companies are using Bitcoin as a store of value. Eventually, pensions and endowments are using Bitcoin as a store of value. Here is the Etheruem Chart:

The next chart shows us the national debt clock. This gives us an idea on where the US stands on debt to GDP, money supply, velocity of money:

Debt to GDP is now over 130%. It will likely go to 200% next year. MMT economists tell us federal debt does not matter. However, with money supply totals being so much higher than velocity of money totals. That tells us that foreign central banks like Russia, Iran, and China are hoarding US Dollars. Why? Because they are only releasing USD into circulation as required. These foreign central banks have to hoard USD as long as it retains global reserve currency status. Once that is lost, what will they do with those dollars? Here is the St Louis Fed showing the Debt to GDP ratio. It got to 135% and has since fallen. However, after this 900B stimulus bill, it will go back up. More growth to come in 2021, click here to read more.

At some point, years into the future we expect. Out of control Debt to GDP, low velocity of money (M2), high money supply (M1), will all lead to more pressure on the global reserve currency status. How long would this take. Years, we don’t know. The Debt to GDP already went from 90% in January to 135%, then down to 128.8% in December 2020. It could easily swell to 160% to 180% by December 2021. We have discussed the stock market being propped up as much as it has by the Fed buying bonds, creating bank reserves, then allowing Fortune 500 companies to borrow against these bank reserves to buy back there own stock and prop up the price. This creates windfalls for the board of directors. But what about US investors. SPX P/E ratios average 37 in December 2020. That is exponentially above the normal P/E ratio just a few years ago. Many institutional investors, hedge fund managers, and public companies are buying up Bitcoin as a hedge.

Nuetral ATM has fronted the institutional investors by loading up on Bitcoin in March and April. Investors need to front the institutional investors as well. Eventually, it will be too late. We see the USD heading for a cliff, we see Bitcoin as the preferred store of value for wall street and institutional investors globally in the future. Get on board now, don’t get left behind.

Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.