Sovereign Debt Bubble is pumping! Got Bitcoin?

"We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power." Alan Greenspan

This quote was from the 90’s, but it holds true today! The sovereign debt bubble is the greatest threat to US national security, not the crypto currency market. However, despite ridiculouse FUD (fear, unbelieve, and doubt) in the media, this sovereign debt bubble keeps pumping and Bitcoin along with it! Debt bubbles have very far reaching negative consequences, and hard digital assets, with a fixed supply, have very far reaching positive consequences! See the difference. It is stark, especially in 2024, 2025, and beyond!

Below is a chart of revolving debt in the US. It is now approaching $1 Trillion, up from $740 Billion:

Then, look at this brief article about Saudi Arabia. They are buying Russian Oil then laundering it into Europe to avoid US sanctions. The Russian sanctions have turned the Middle East, Russia, and China firmly against the US dollar, and many other countries are following suite, click here to view on twitter.

See the BRICS reserve currency blogs we have written, click here to read more.

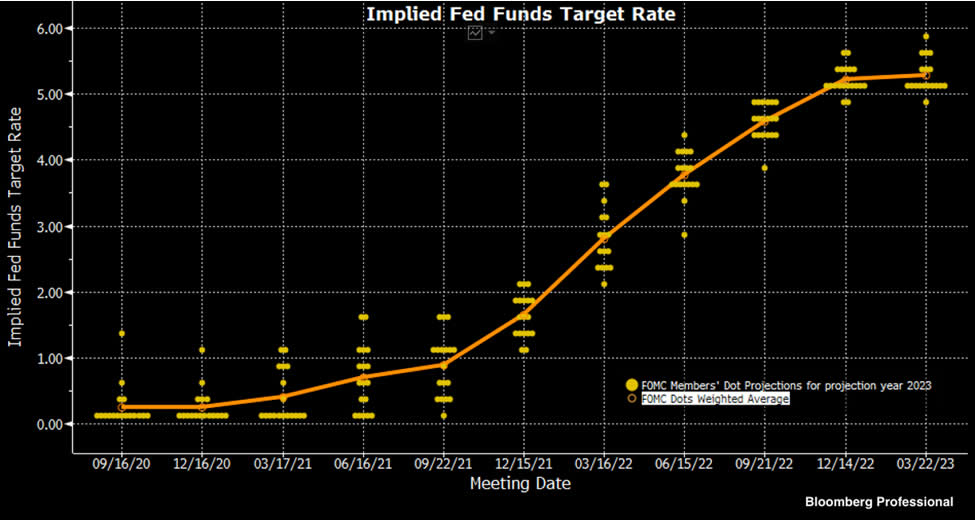

The US just reported a loss of $378 Billion for March 2023! Wages have decreased in the US for 24 consecutive months. As bonds mature in the 3rd and 4th quarter 2023, debt will roll over to the new higher rates. What will this do to the stock market and real estate? It’s not pretty. That is what a sovereign debt bubble is. Rates rose higher, and much faster than expected last year. Now that debt load of $32 Trillion is rolling over in a few months to these new FFR (Fed Funds Rate) levels. Thanks to James Lavish for these next four charts! The target rate for April 2023 set in 2020, per this chart below, was 1.8%. Yet the FFR is 4.83%! What will happen to Institutional investors funds when their debt rolls over? See this chart below:

This next chart is the actual FFR rates. Compare the two charts. The implied targets were off by 300+ bps by April 2023:

When Pension Funds, Institutional Investors, Hedge Funds are expecting an FFR that is 300 bps lower than it actually is. The carnage that follows the debt rolling over to the new rates, is unimaginable! This bubble will dwarf previous bubbles. The question is how long can they kick this can down the road from here? CPI came in at 5% yesterday. Yet we know shadow stats shows a much more accurate CPI of 9%. See this below for an understanding beyond statistics as to why we do not trust CPI data:

Another indicator that inflation is a much worse problem than the media indicates is poll results to this question. Is inflation a major factor in you day to day life since January 2021? 64% of respondents to this Rasmussen Poll answered Yes. Then, look at Bitcoin and MSTR (Micro Strategy). MSTR holds their cash reserves in Bitcoin, they are the largest Bitcoin hodler on Earth. Those two are outpacing all stock indices by 7X yesterday:

Year to date Bitcoin is up 80%. It is the #1 asset for returns of 2023. The problem is everything else is struggling and trending down. Bitcoin could be dragged down somewhat by this sovereign debt bubble as well. Time will tell. We see high inflation coming back. This final chart is the main reason why. The US cannot continue to drain out the strategic petroleum reserve, after Russian Ruble sanctions, after kicking Russia out of the Swift banking system, and expect the USD to survive long term:

Even this week, the SPR has been draining out at alarming rates. It is supposed to be used during war time. If or when WWIII is about to begin, the US will be completely exposed and weak with no Oil reserves. What will that do to inflation? What asset is performing while everything else is not? Bitcoin is up 82.8% YTD, Gold is up 12.14% YTD, Silver is up 8.5% YTD. Bitcoin is the only inflation hedge asset that gives total transmutability, is absolutely capped at 21 million coins, and has a second layer lightening network for medium of exchange (faster transactions). We are not financial advisors and this is not financial advise. The research is out there. Check out @neutralatm on twitter and www.neutralatm.com for more of our blogs. Bitcoin is the lifeboat and the flood is coming! Call me Noah if you want. Just learn and research Bitcoin. That’s all I ask!

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.