Explosion! Part Two

Once Bitcoin broke through $20,000 early yesterday morning. It has gone completely parabolic since! It is now $23,509 and up almost 226% YTD! Unbelievable! Why has it done this? First study this chart:

Neutral ATM really studies global macro economics. That is the key to understanding why Bitcoin is such a great store of value. Notice the dates at the bottom of the chart and the vertical, dotted green lines. The dotted green lines are each halving in 2012, 2016, and 2020. Bitcoin mining reward given to miners when they create a block on the blockchain, is cut in half every 210,000 blocks. That works out to almost every 4 years. When Corona Virus started and stocks dumped in mid March, Bitcoin dumped as well, 60%. However, on May 11 the halving occurred. By May, the Fed was already printing trillions in stimulus for the lockdowns. Now the Fed has printed $5 trillion and that will increase next year significantly. Yesterday, we showed how the dollar has lost 96% of its purchasing power since the Fed was established in 1913. Keep in mind, interest rates are near 0%. There are $17 trillion in zero yield bonds and the Fed is stating they will keep trying to reach 2% CPI inflation. They will keep printing. What is going to happen to these $17 trillion in bond investments. Bonds are supposed to yield 7% or so. They are around 0.5% to 0.25% right now, no end in sight. There is a serious solvency crisis going on and the Fed is the only backstop.

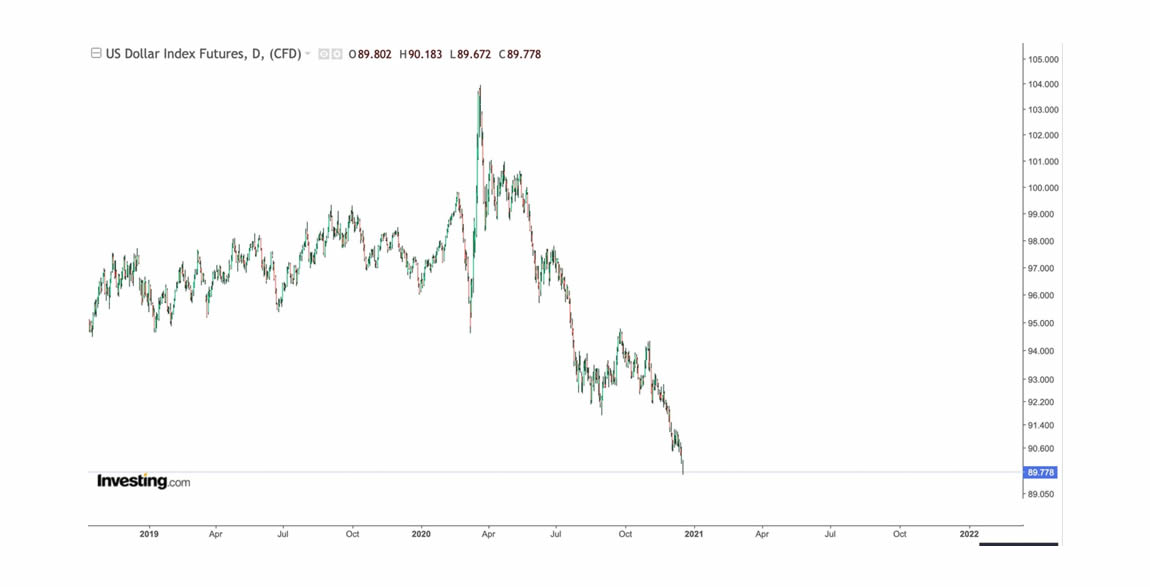

Mass Mutual invested $100 million early this week, or it was made public anyway. That means they know there is no yield in bonds, and they are the first insurance company to invest. Many will follow. $18.5 billion of Bitcoin is currently held in public company cash reserves, and that number is doubling every few months. If a small % of bond holdings flow to Bitcoin, the price could grow to levels none of us are talking about in this bull market cycle for 2021, early 2022. Perhaps that could even mean the cycle goes further into 2022. Below is a chart of the US Dollar futures index. It is sloping down 65 degrees:

Bitcoin has an inverse coorelation with the DXY, which is the US Dollar index. Gold and Silver have the exact same inverse coorelation. Here is another chart highlighting the 2018 bottom in the DXY and how we are now near the same level:

The difference this year, is Corona Virus. Stimulus is desperately needed, Congress is in session on a new spending bill after having passed one last week to keep the Government operating. The DXY will keep droping. Neutral ATM does see a deflationary crash or event coming at some point, but Bitcoin, Gold, Silver, and the US Dollar are all likely recipients of that “flight to safety”. Long term, Bitcoin is the best recipient due to the scarcity we discussed after the first chart of this blog. Scarcity in light of loose monetary policy, in light of a pandemic, equals high demand levels in scarce assets. Real Estate, Gold, Silver, and Bitcoin are the main such assets. However, Bitcoin is digital, and provably scarce due to the blockchain. It can be counted and proven scarce. It is mobile, unlike Gold. The next chart below compares 2020 returns between Gold, SPX, and Bitcoin. Money is flowing into Bitcoin for all these macro economic reasons. This chart shows it visibly:

The dollar is quickly losing value, use Bitcoin to store wealth long term. Use it to send money to family out of the country. Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.