Conviction

We all have to believe in something. For me it’s God, Family, and Country. But when it comes to investing for the future. That is where it gets interesting. Many don’t think about that enough. Long term planning, and understanding the global macro back drop, is key to making smart financial moves. Bitcoin, in this era, is THE smart financial move. Here is why. Bitcoin cannot stay illiquid in terms of supply demand for long. See below:

When demand is low and Bitcoin becomes illiquid, the halving shocks the supply and decreases it, until eventually, demand improves, and sparks a bull market. This halving of the miner reward every 210,000 blocks completely seperates Bitcoin from every other crypto currency, and other assets like Gold, and Stocks. The built in programmable scarcity of Bitcoin is something investors have never had before. Until 2009 when Bitcoin came out. It also exposes the legacy financial system for fraudulent money printing, and debt based economies it produces globally. These economies will collapse under the weight of their currencies money supply growth. Even the legacy banking system has now gone from calling Bitcoin a fraud or a ponzi scheme, to a store of value. See below:

The light black line above is Bitcoin price action. JP Morgan, and most hedge fund managers scoffed at Bitcoin until this bull market we are in now. Now the institutional investors are here, 8 Bitcoin ETF’s are coming online. US Bank will now offer crypto currency custody. They are the 5th largest US Bank, $500billion in assets. Iran will now allow it’s central bank to hold Bitcoin and use it to pay government debt. The Iranian central bank already mines Bitcoin. Below is the US M2 Money Supply. It has grown nearly 5X in 21 years! Yet, some deny inflation is much higher than the CPI reported 2.5%? When will the US Fed put Bitcoin on the balance sheet, and mine it?

The great reset we have been hearing about this year and somewhat late last year, is a financial reset. It involves many things, but the primary reason for the reset is financial. Central Banks cannot control the yield curve (keep interest rates low) indefinently by printing currency. Inflation will hit, there is no way around it.

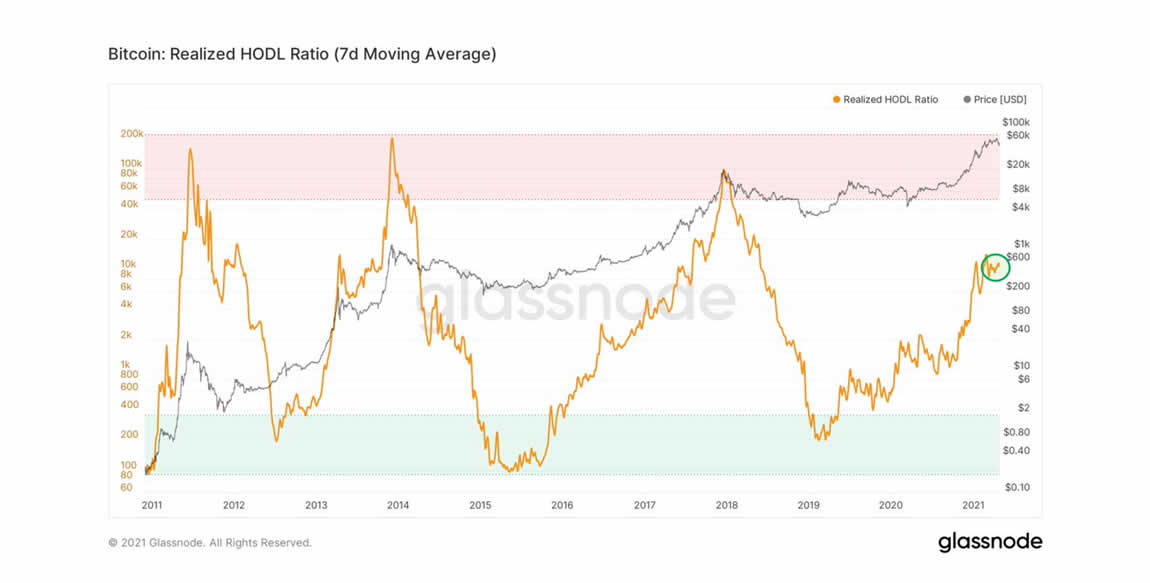

Those who continue to HODL Bitcoin, have checked out of the legacy financial system, and they are holding a scarce asset that truly hedges against all central bank money printing. Central banks are private organizations, globally, and they enrich the few, yet put the many into debt. It is unfair, and unethical. Bitcoin puts an end to it. The last chart which begins to prove this point is the Realized HODL Ratio. After the leveraged longs and shorts were liquidated when Bitcoin jumped from $47K to $55K, and climbing now. The ratio reset itself, the deck has been cleared, Bitcoin can move higher now. See the chart:

If this proves out and Bitcoin gets above $75K in the next month. We think that does happen. Then, perhaps, we could draw a conclusion, that the bull run is half way through and has much longer to go. Maybe even to the very end of 2021, it could possibly stretch in to 2022 a little. Too soon to tell. We will keep analyzing the charts and discussing that hypothesis here.

Neutral ATM buys and sells Bitcoin as little as $20 at a time! You do NOT have to buy an entire Bitcoin. Our OTC Desk is coming online soon, low rates, buy or sell online 24/7/365. Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.