Bitcoin; What about China’s $60 trillion Real Estate bubble, or the inflation bubble, or the equities bubble?

“The fragility in China’s real estate sector could spread to the U.S. if it deteriorated dramatically”. Fed Chairman Powell

Below is a chart, that shows how home sales, and property investment in China, has dropped from +120% to -50% in 18 months. The real estate industry market cap in China, is $60 trillion and they expect a -30% crash in values. How will an $18 trillion real estate crash in China not effect the US? China is the largest holder of US treasury bonds. Here is the chart below:

Now, there are mortgage revolts going on in China. Whereby, 30% plus of all mortgage holders are refusing to pay. Property developers there, built housing projects, and expected payment before construction. Now many of those projects are delayed, and the home owners are refusing to pay. Here is an example of mortgage revolts in China:

Below is a chart for home supply for sale. The supply of homes for sale has grown to 2008 levels and the China crash has just begun:

Then there is the US debt spiral!

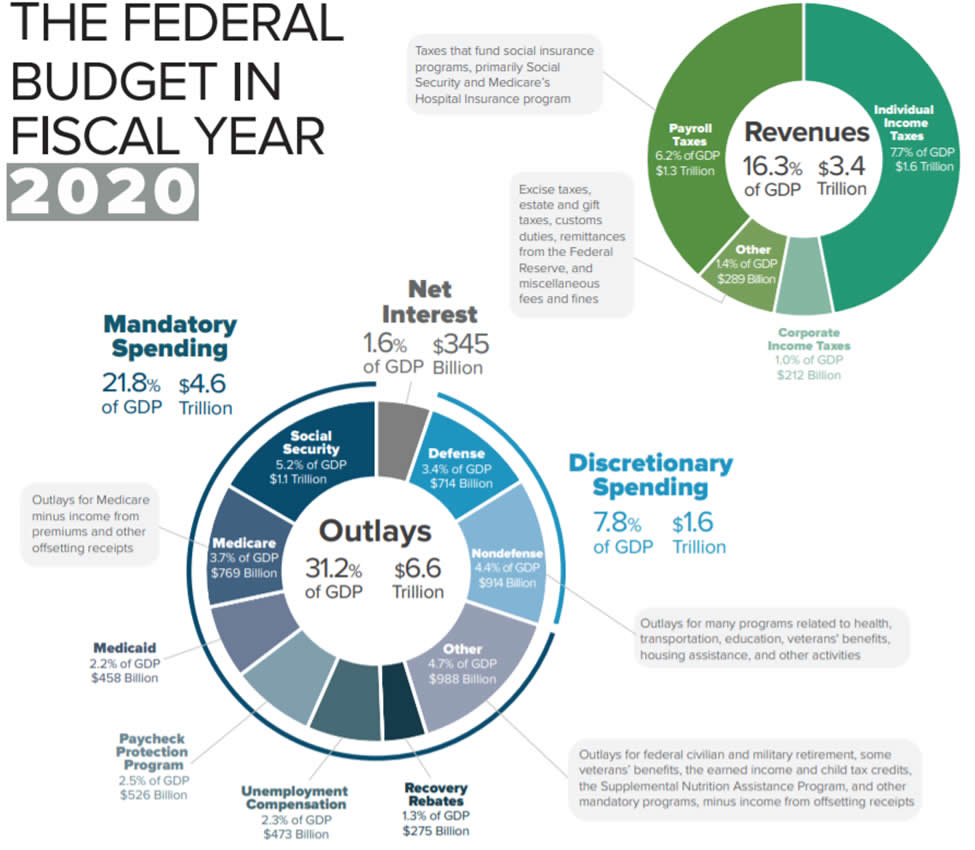

$4.8Trillion taxes - $3.7Trillion entitlements - $800Billion defense = $300Billion budgeted for interest expense. However, the problem is actual interest on the $30.7 Trillion in national debt is $400Billion per year. Then, in this next chart, the US has $3.4 Trillion in tax revenues on $6.6 Trillion in outlays. Thus, this debt interest expense is growing year over year. Debt to GDP is about 130% now! Here is a chart pointing out the budget shortfalls:

Michael Burry has this chart below showing that equities are on a similar track as the last two major recessions (2001, and 2008):

Recently, we showed energy costs in Europe spiraling out of control. They are expecting inflation in Europe of 5% per month, 60% per year. Inflation, housing bubble, and equities bubble all getting ready to explode! This has been driving Bitcoin adoption and as this all unfolds later in 2022, and into 2023. Expect Bitcoin adoption to explode big, to the upside! Bitcoin is a hedge. If inflation does explode up as we truly expect over the next two years. It is already high now. The DXY (US dollar index) will drop down, and Bitcoin prices will explode up. This will be gradual, not all at once. However, buying Bitcoin while it is still cheap, sell stock, sell real estate, whatever you have to do. This is the best move in 2022! Waiting until Bitcoin is expensive. Not the best move! We are not financial advisors, and this is not financial advise. The global monetary system is in serious trouble, don’t whistle past the graveyard. Don’t be distracted by this rat race for a fiat currency that is losing it’s buying power at a rate of 17% to 20% per year. Buy Bitcoin and enjoy freedom which comes from owning a scarce, and appreciating asset. It gains buying power, instead of losing buying power like fiat currency. See this picture below to clarify it for you. Banks don’t want us to know about Bitcoin. We have to find it for ourselves:

Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.