Sign up to Receive Updates from Neutral ATM

Bitcoin & The Ongoing Currency Devaluation

Below are examples (generally) of year over year price increases on commodities and services that are commoditized:

- Lumber +300%

- Meat +100%

- Copper +200%

- Transportation +100%

$11 trillion of USD has been printed since January 2020! Real inflation, we predicted Monday, will climb to over 20% in 2022. By 2023 that could be over 30% to 35%. Retirement requirements are often $2 million to $3 million for most middle class Americans depending on their age. According to wealth advisors, with series 7 licenses. Yet, that ignores inflation! They look at CPI inflation which is under 5%, although it was 1.4% last year. Hilariously, CPI uses a ratio back to inflation rates from 1982 to 1984. So CPI multiplies it’s formula to this ratio. Inflation in those years was 8% to 11%. So when CPI shows 4.5% and is ratiod against inflation in the early 80’s. That would add up to 12% to 15% now. Yet in future years this inflation will grow EXPONENTIALLY! Paul Tudor Jones calls it the great monetary expansion. Stanley Drunkenmiller, Ray Dalio, Paul Tudor Jones, Warren Buffet (greatest hedge fund managers, and investors in the US) agree inflation will outpace what the experts think it will. Other than Buffet, they have all invested substancially into Bitcoin. In addition, Cathie Wood, Elon Musk, Jack Dorsey have all invested very heavily into Bitcoin for it’s scarcity and inflation hedge properties.

If you personally think inflation is not dangerous. Look at history. In 1965 Lyndon Baines Johnson spent and spent on the “great society”. M1 money stock or money supply moved up for that time. By 1970 real inflation was over 25%. Stock prices began falling in 1968 and they did not recover (inflation adjusted) until 1993! Can you afford for stocks to drop over 50% and not recover until 2046? It’s called stagflation. The US is entering into stagflation. Millions of Americans are about to lose their savings and retirements to this. We showed these charts Monday, but here they are again. Money supply in Germany 1914 to 1924, the Weimer Republic:

US money stock or money supply chart going back to 1960. You can really see the increase in money supply since 2009:

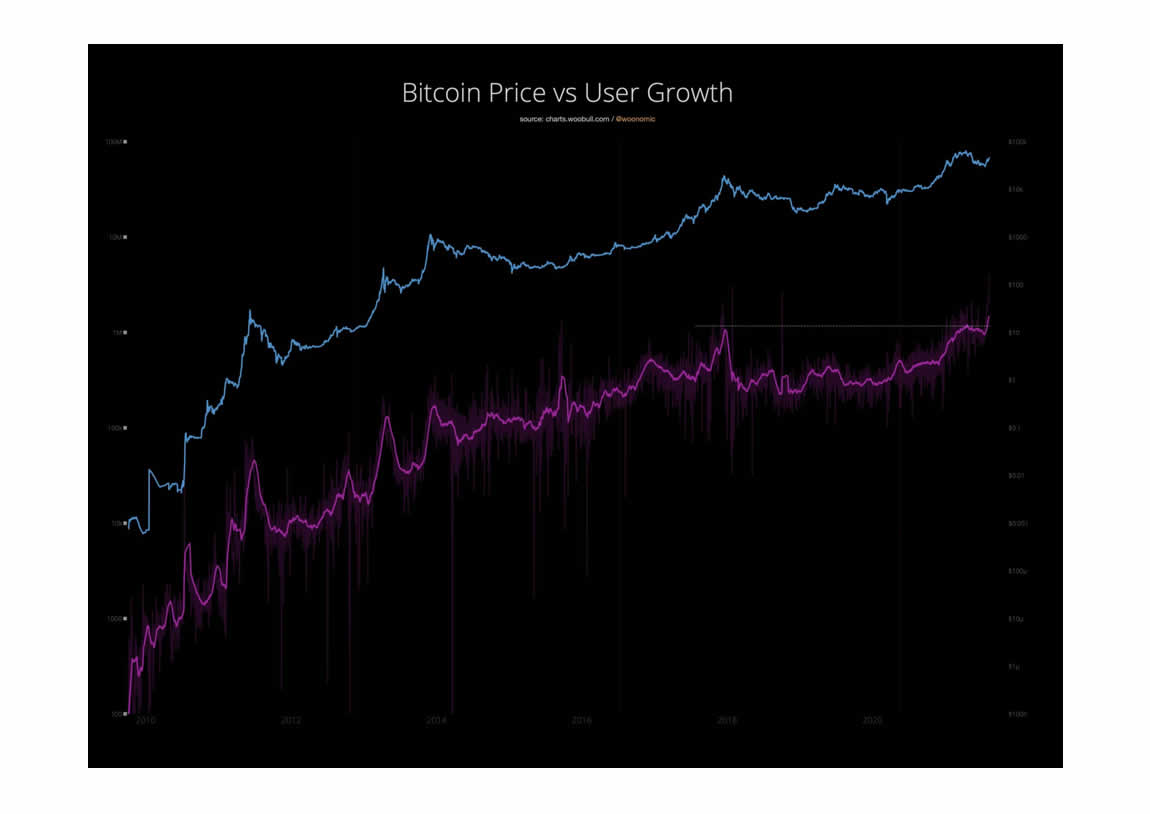

The overall pattern is the same. Perhaps the US stagflation will end up more gradual than the Weimer Republic in Germany. We sure hope so. It cannot be denied at this point that inflation is here. Commodities are increasing violently in cost, and supply of things like computer chips for cars and trucks are getting scarce. This is not financial advice. We just see inflation eating savings accounts for decades to come. This is a warning and we see a solution. In general, scarce assets are the solution. Art that is rare, real estate that is rare and hard to get, best of all, Bitcoin. Bitcoin is scarce, and as signs of inflation increase the demand for Bitcoin is getting bigger and bigger. Below is a chart comparing Bitcoin price versus user growth:

Thanks to Willie Woo for this chart. Since the infrastructure bill was signed yesterday. Inflation increases are now guaranteed. Expect those to begin taking effect over the next 2 to 6 months. This is happening simultaneously with the second leg up of this 2021 Bitcoin bull run! It could get explosive! In the next chart from William Clemente, we see the red vertical line for the reset of the market in Sept 2020 and again in May 2021. Now in Aug 2021 we have the vertical green buy signal. Bitcoin went from $15K to $65K the last time (Sept 2020) we had this reset signal. This reset has been far more violent down than last September. We could envision a 5X to 6X from here but only time will tell:

Although the infrastructure bill had some things in it that do not make sense, from a reporting standpoint. We cannot see how the US Government can do anything to a public ledger without any borders. Exchanges can migrate overseas just like miners migrated out of China. The world needs a public ledger for money because currency devaluation is wide spread now and will get worse in the future. Decentralize away from the Fed and central banks worldwide. Scarcity will win in the end. Choose Bitcoin!

Neutral ATM buys and sells Bitcoin as little as $20 at a time! You do NOT have to buy an entire Bitcoin. Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.