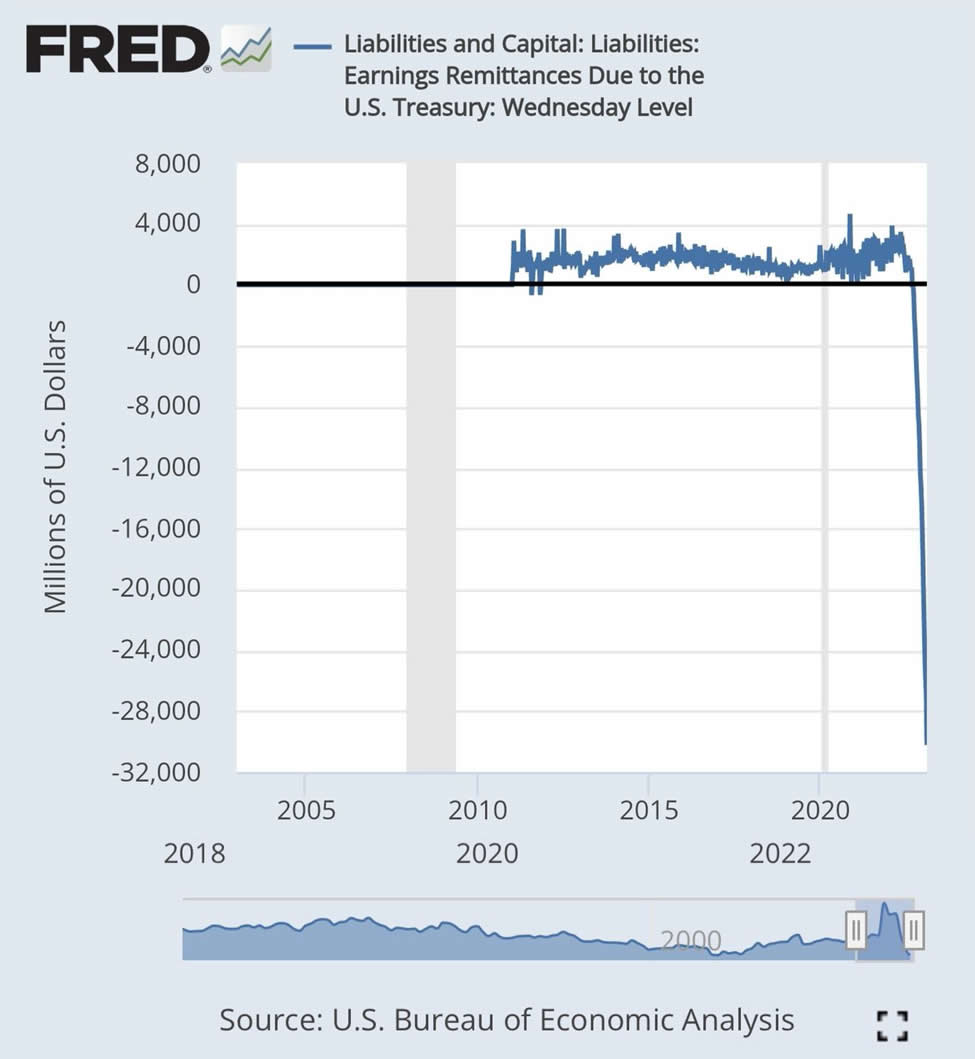

Bitcoin, The FED is losing Billions per month, the Treasuries deficit is up to $30 Billion per month now!:

The tax cuts from pre 2021 have expired. The stimulus money from Covid 19 has been spent and is not being replaced anymore. In this next chart we can see personal savings is down to 3%. 64% + of working age adults live pay check to pay check. Likely this number is much higher, however, we have little to no proof of that. The chart below from Lyn Alden, shows the trend of personal savings rate:

The FED has to pay the Treasury for deferred assets. That means if there is a shortfall, instead of the Fed actually paying the Treasury. They accrue deferred assets. It’s on the balance sheet of the Treasury, the Fed has to pay it back. At this point, deferred assets are -$30 Billion/month! This currency cycle has reached it’s end!:

M2 money supply is $22 Trillion as of January 2023. So, that means money supply getting this high with Fed Fund Rates being 4.5% to 4.75% presently, means inflation is NOT under control and WILL remain sticky. Regardless of the Fed Fund Rates. FFR is not getting to the level of real inflation 15% to 20%. That is what it would take to truly control inflation! More on that in a minute. Here is the M2 money supply chart:

CPI is not accurate. The chart below is of the index which = 1. Why? Because this index is a ratio used in the CPI calculation. This calculation multiplies CPI by the ratio of inflation in 1982 to 1984. Back then CPI inflation was 9% to 12%. As this chart below shows, this ratio which is 1, keeps increasing, perpetually:

Therefore, CPI inflation is moving further, and further behind real inflation! Today, that spread is 6.4% for CPI inflation vs 15% to 20% depending on your geography, for real inflation. For more information. Go to www.shadowstats.com.

Bureau of labor statistics reveals it cannot measure the CPI properly, at the present. Per shadowstats.com.

Per Lynette Zang, “Saudi Arabia is accepting other currencies for oil, thereby threatening the US petrodollar”. OPEC+ is doing this as well, the + is Russia! None of those countries are selling oil for USD. IMF SDR (special drawing rights) or BRICS reserve currency are likely future reserve currencies to replace the US dollar! Lynette Zang also warns about CBDC, because that currency would automatically be at a negative interest rate. In other words, if you don’t spend your CBDC in your account, it will eventually become worthless.

Lyn Alden compares the accounting of central banks to a remote border:

“Unlike a commercial bank, a central bank can just keep functioning with negative equity and indefinite losses. Positive equity is just an imaginary line to preserve the idea of central bank independence, and can be maintained with accounting gimmicks. It’s like standing somewhere deep out in the wilderness right on some unguarded part of the border between Canada and the United States; the line might as well not even be there. Deferred assets are the modern equivalent of non-redeemable gold certificates.”

See the spike in this chart with interest payments from the Fed. It is a hockey stick up! The hockey stick down chart was above, remittances from the Fed to the Treasury. If Fed interest payments are straight up, and Fed remittances to the Treasury are straight down. Then the US government is truly, broke!:

Then, what is the biggest bank in the US doing, in light of this?

Jamie Dimon – JP Morgan Chase Bank:

"We are proud of our long-standing support of Ukraine and committed to doing our part to lift up the country and its people." Dimon then pledged "The full resources of JPMorgan Chase are available to Ukraine as it charts its post-conflict path to growth."

Bitcoin was created as a truly decentralized hedge against out of control money printing, and central bank control. The SEC calls Bitcoin a commodity, yet they call alt coins securities. Bitcoin as a commodity, like Gold and Silver, is much akin to extremely valuable property. It will not lose it’s scarcity due to printing like fiat currency will and has. It gets more scarce over time! NYC real estate is that way as well. As inflation gets worse, and it will. Scarcity will become much, much more valuable. That is why holding Bitcoin is impartive. Scarcity! Bitcoin is progromatically scarce, that is where it's value comes from. When it’s denominator is USD, that value becomes exponential! We are not financial advisors and this is not financial advise. The monetary sytem is NOT well. Preperation is imperative!

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.