Bitcoin; The Fed can control Inflation? Really?

Bitcoin always inverts the DXY, (US dollar index). So, when Fed monetary policy “tightens” there is selling pressure on Bitcoin. When it “loosens” there is buying pressure. Therefore, today we will look at what should influence Fed monetary policy going forward. Will they tighten or loosen, and when will they pivot? Because that, more than anything else, determines global macro outcomes. Now, we already know the bottom is in. That was $17,500 back in June. The charts tell us that. However, will the Fed just keep tightening so much that Bitcoin drops below that level? What are the chances of that?

Below is the historical Bitcoin price chart, along with monetary, and fiscal policy anecdotes along the way, click here to read more.

For more incite into this, here is a coin desk article about future predictions of Fed monetary policy, based on the July FOMC meeting minutes, click here to read more.

Based on the minutes, the Fed remains strong in their conviction to raise interest rates and hold them elevated for however long it takes to bring down inflation. Remember that this is the primary goal of the Fed’s policy in 2022.

Higher debt servicing costs take money out of the hands of companies, and citizens alike. With less savings comes less spending, and thus, lower prices. Below is a short term debt cycle chart from Blockware Solutions:

What will influence these monetary policy decisions in upcoming FOMC meetings?

This next chart shows us that core sticky CPI inflation% compared to core flexible CPI inflation% is what the Fed looks at. They need there rate hikes to eventually bring down sticky CPI%. In this chart below, we see sticky CPI% has not even peaked yet, and is 40% above flexible CPI%:

Two weeks ago in a blog, we mentioned an ex Federal Reserve employee, stating that it would take 30% rates to kill inflation. Obviously, that cannot happen. Then, you take that, and look at the impact energy prices are going to have this fall in Europe. This chart is from Germany, and looks at the future energy costs there:

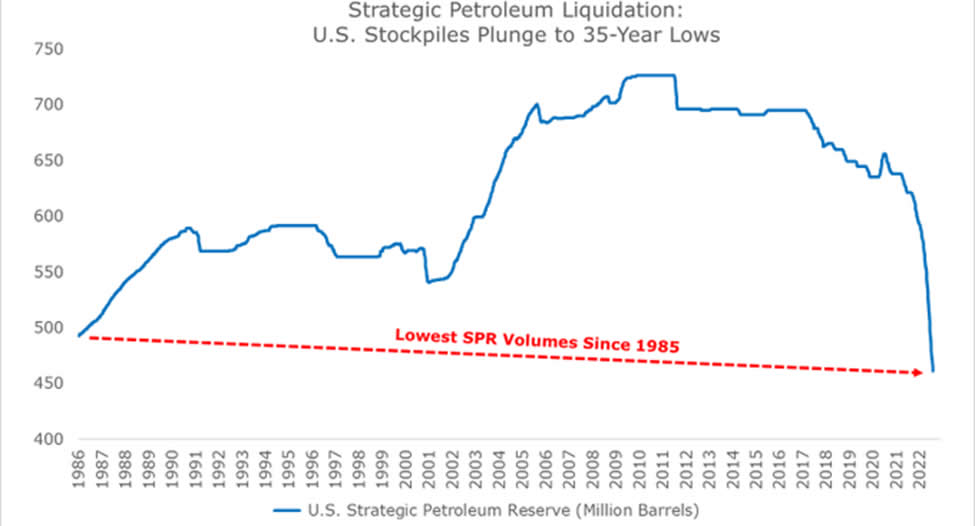

We see inflation being a much bigger problem in 2023 than it is now! If the Fed cannot really control inflation that much now, how will they when the SPR (strategic petroleum reserve) is drained out moreso than it is now? If we look at crude oil stocks, we see of the reported 430 million barrels reported since 1/2021. Almost 200 million barrels came out of the US SPR, (strategic petroleum reserve):

SPR (strategic petroleum reserve) levels are now at 1985 levels, a 35 year low!:

Oil and Natural Gas prices are leading indicators to inflation. They are the leading components! Thus, as the SPR keeps draining, it masks what these dangerously low reserves will do to future inflation % levels!

In closing, how can the Fed expect to truly control inflation with rate hikes. Especially when you consider the FACT, that as Fed Funds Rates increase, that increases the cost of debt service for the US Government and all Governments, globally. Never in history have so many nation states had debt to GDP levels so high! After the November mid term elections. These low SPR levels will have to reversed! In other words, the reserves will be filled up in 2023-2025. To some extent at least! When this does happen, gas prices will soar again! This will make inflation soar. Draining a nations oil reserves is a short term bandaid for inflation control. Yield curve control has done little to slow down inflation. To push yield curve control that hard, would bankrupt treasuries globally. This cannot happen. Therefore, asset prices will eventually start getting inflated again.

Unless, a reset to a new monetary system is begun. We read executive order 14067, about CBDC’s. They are scheduled to be rolled out late in 2022. December 13th. We are unsure if this actually happens, it could easily be reversed after the mid term election results are known. CBDC’s are not good either, as they bring about a surveillance state whereby nobody has any privacy, and our constitional rights are violated every moment as we are surveilled by the digital monitoring system which CBDC’s would establish.

All we really know is, Bitcoin is an alternative monetary system outside of government control. Outside of central banks control. It is the only free market, peer to peer monetary system in the world. The blockchain is 13.5 years old and keeps a public ledger of every Bitcoin transaction. We are not going to trust CBDC’s. We are not going to trust central banks. We do not believe the Fed can control inflation long term. Bitcoin is the lifeboat! Get onboard, it is up 579% since March 2020, when the pandemic started. That outpaces inflation and it is 100% secure if you control your own keys to your Bitcoin. Focus on security and don’t sell Bitcoin. Buy every day, week, or month. Follow our blog and we will show you the best buying opportunities whenever they arise! This is not financial advise, and we are not financial advisors. Buy Bitcoin because it is the only option to decentralize AND beat inflation, in the same asset! Embrace the volatility!

Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.