Bitcoin on exchange vs off exchange

There is now $416.5 Billion in Bitcoin sitting away from exchanges, and $29.2 Billioin on exchanges. There are 14.26 times more Bitcoin off exchanges than on! The FTX exchange appears to have helped speed this process along. It has also helped take paper Bitcoin out of circulation. Perhaps that is why Bitcoin was up 40% in January! One thing to keep in mind regarding Bitcoin off exchanges, is that it will take a lot of time for this to impact price action.

Jeff Currie of Goldman Sachs just called Bitcoin a commodity with no liabilities. It is not a security due to it’s lack of a liability attached to it, click here to view on Twitter.

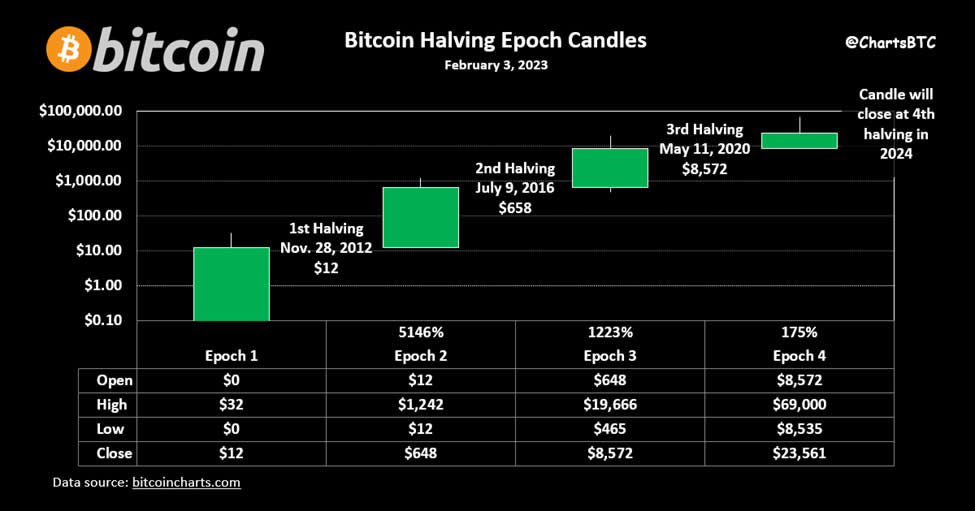

The backing of Bitcoin is not the US military as the US dollar is. Instead it is the proof of work of the miners, and node operators that support the blockchain. It is backed by power, and until a miner’s ASIC computer can solve an algorithymic equation, it cannot receive the miner reward. We have blogged a lot about that reward being cut in half every 210,000 blocks. This keeps Bitcoin on a rhythm, and is why bull market happen around the halving, every four years. So not only does Bitcoin revolt against CBDC (Monday’s Blog), it also revolts against modern monetary theory that promotes inflation by printing fiat money indefinently. Obviously, inflating a currency debases it’s value and buying power. Since March 2020, the US has added $7 trillion in new debt, and now the debt ceiling debate will likely raise it again this summer:

All food staples are now up 20% since January 2021, Gas is up 40%, CPI inflation is up 382% in that same time frame. Now the rate hikes are slowing and asset prices and risk on assets are climbing again. Yet this is unsustainable, long term. Janet Yellen is taking extreme measures to avoid a US treasury debt default by taking money from pensions, see this article below, click here to read more.

Raising debt limits does not solve this problem. It worsens it, long term. Yet every political party does it. Its so bad in the UK that they will propose banning saving money with their CBDC (Britcoin). They will make it illegal to hoard the Britcoin, spend it, or the money will be extracted from your account. See this headline from yesterday:

The need for a CBDC is to control inflation, by controlling the velocity of money, through government stipulations to the use of the CBDC. Speeding up velocity of money will reduce the effect of untapped money printing. CBDC gives the government that control. This means the central banks, which are private, really own these governments. Unelected central planners.

This is another area where Bitcoin comes in. Seperation of money from state:

When debt ceilings are continuously raised and the debt to equity ratio gets to 400% and above. This is projected to happen in the US in the next 15 to 20 years.

Bank runs happen. Case in point, Nigeria. The central bank has been burned in that country, and inflation is out of control. People rush to get their money out of banks, and buy whatever they can before it becomes worthless by dinner time, click here to read on Twitter.

Nigerian Central Bank on fire, click here to read on Twitter.

Yet, Bitcoin is selling for double it’s listed price in Nigeria due to the central bank charging remittance rates that high. Those in Nigeria with phones and a Bitcoin wallet can get Bitcoin without that fee. Bitcoin is survival in Nigeria now.

In the US, as Bitcoin on exchange continues to drop, it is down to 6.5% now. As that drops, and as more Crypto Exchanges are flushed out, which previously sold paper Bitcoin as FTX did. By 2024, when the next halving is, and for the year to 18 month period after that, Bitcoin price action will continue rising. As that happens, more adoption will come in. We imagine the bull market top will happen sometime in 2025. Too far out to narrow down right now.

See this chart below for the growth rate Bitcoin achieves in each halving cycle. As the adoption curve gets more mature, the returns get less volatile, that is obvious in this chart:

So in closing. Keeping Bitcoin off of an exchange or a hot wallet, where it is online and susceptible to hacking is critical. As the adoption curve matures more people understand this fact and get their coins offline. That maturation process brings about more scarcity for Bitcoin, then the halving occurs and scarcity doubles. That is the cycle we have been refering to. Scarce assets perform better than loose assets, like cars, and fiat cash. We are not financial advisors and this is not financial advise. Trust Bitcoin longterm, keep it offline. Let the halving cycle go through the full four years, continue buying Bitcoin and adding to your position. This system works for investing in Bitcoin. It keeps it scarce as well.

Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.