Bitcoin Is Still Consolidating, Change Your Investing Habits

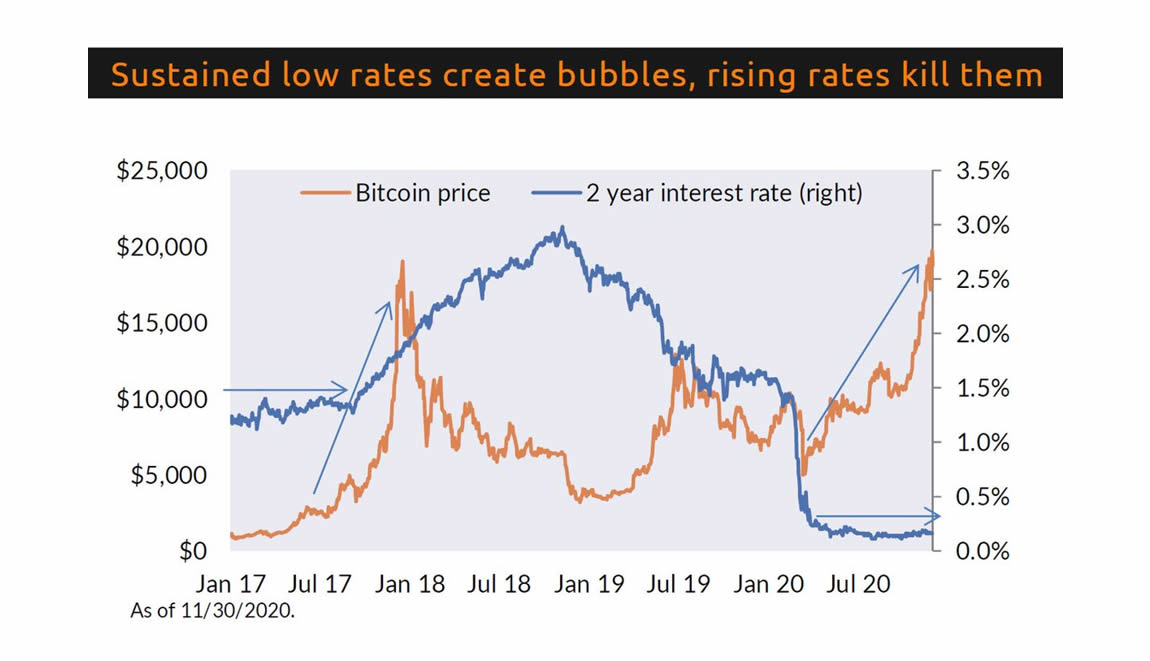

Bitcoin always has massive bull markets that usually last 18 to 24 months after the halving (Bitcoin production cut 50%, every 4 years). Those involved in cryptocurrency know this all to well. What many don’t know is interest rates affect how well Gold and Bitcoin do. They are the two assets most closely correlated. Therefore, if interest rates remain low for the next 5 – 7 years which appears likely, Bitcoin will just keep climbing. It will pull back after the bull run ends in late 2021 or early 2022. However, the pull back severity will be predictable based on interest rates and where the US Dollar is (DXY Index). See the chart below for the correlation between Bitcoin pull backs and rising interest rates:

The DXY is now below 91 (90.63). It may drop into the 80’s but eventually we see a deflationary stock market crash occurring which will send the DXY higher and probably back down again. Bitcoin is driven by interest rates and USD weakness like Gold, but, supply demand is still the biggest price driver. The supply shocks that happen when Bitcoin production drops from 1,800 BTC/day to 900 BTC/day (5/11/2020), cannot be understated. Demand has rushed into Bitcoin since March. Since May production has been half. This creates a supply shock which can take 18 – 24 months to play out. Right now, Bitcoin is struggling with breaking the all time high (ATH). It jumps above then dips below this threshold. In the 2017 bull run it took a few months to break through. Thus, we preached patience in yesterdays blog. See the stock to flow model and use it as a guide. It tells us where the halvings are and calculates the distance in time until the supply shock will begin to affect the price:

The accuracy of this S2F model has been deadly for a decade. If this model is all you understand from our blogs. That is enough. See the white line straight up beginning in Jan 2021. In previous bull runs the supply shock began affecting the price before this white line turned up almost 90 degrees. However, after the white line turns right on the chart the price continues rising for about a year after that. Consequently, that takes us to around about January 2022. There are other moving average crosses, the fear and greed index, the % supply in profit index we can discuss when Bitcoin is close to topping out at the end of the bull run. Plan B, the inventor of the Stock to Flow model has consistently predicted $288K as the top. We shall see. Neutral ATM remains conservative in the $150K to $250K range. We read the charts, moving averages, indexes and will take a fact based approach to laddering out and protecting profits. We will write about it when the time comes. Right now, people just need to invest. US Dollars are being melted, see below:

Raoul Pal one of our favorite Hedge Fund Managers did, see on Twitter.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.