2023 will be about surviving a housing and stock market crash, while invested in Bitcoin!

The everything bubble is crashing. We have been saying this for a year and it is no less true now than New Years 2022! Stocks and Real Estate values are down. The crash has not even started yet. This will show how we got here. Then, we will look at how Bitcoin helps us dig out.

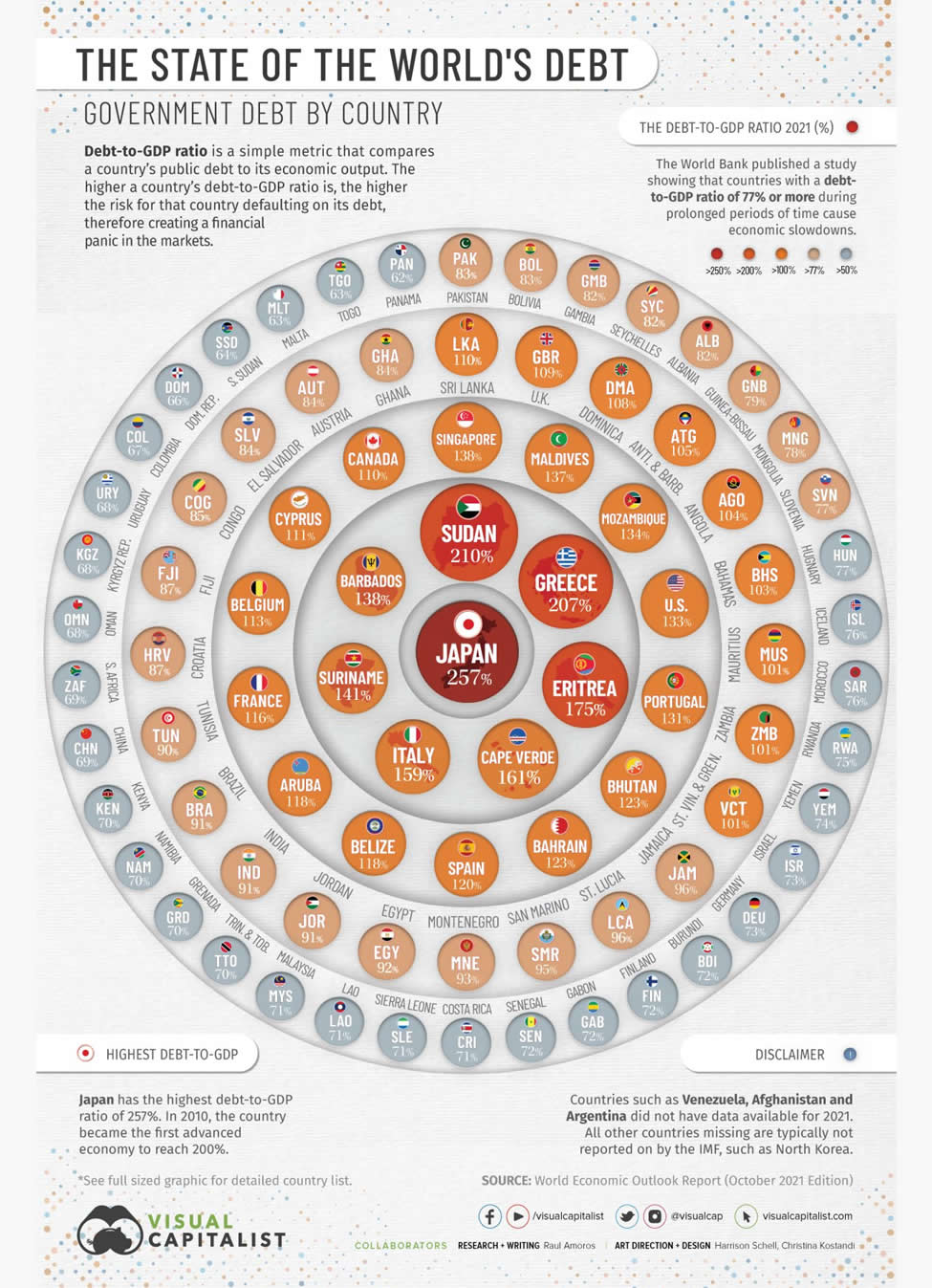

The US ranks 12th in the World, out of 200 countries in highest debt to GDP ratio. 133% total debt to GDP, see this chart below:

Yet the US Dollar is the global reserve currency. Read this blog from last week about the threat to the USD, as global reserve currency, click here to read.

Below is a chart on government revenues vs government outlays. Spoiler alert, outlays are twice as high as revenue:

Years of quantitative easing since 2009, led to run away inflation, which led to 2022’s quantitative tightening. Now interest rates have risen from 0.8% to 4.3% (Reverse Repo Agreements). That means government outlays are going way up due to the cost of debt service. Here is a chart on that:

We can also watch the XHB which is the homebuilders index, it is closing in on 52. If it breaks that support level it will be a 2008 level freefall. Hedge Funds are already shorting XHB in this chart:

Homes have lost 7.6% of their equity in 2022. 2023 should be much worse. XHB losses could trigger a stock market sell off, like in 2008:

If we are correct that real inflation is 15% to over 20%, while CPI is now 6.5%. It is fair to say inflation is much worse than CPI appears. That should be obvious, since real inflation considers food, rent, housing as parameters while CPI does not. Not to mention the ratio back to inflation of 1982-1984, imbedded into the CPI calculation. Inflation is being hidden. Main Stream Media throws FUD at Bitcoin during this bear market. As the economy is slowly going over a cliff. While hiding real inflation from the population. The general public is not often made aware of the real inflation being 15% to 20% depending on geography in the US. This is by design. The manipulation of interest rates through QE or QT allows demand to strengthen or weaken, thereby manipulating inflation. Yet, when debt to GDP is this high, there is not as much room to raise rates before debt service becomes insurmountable! That is where all of the G7 countries are right now. It’s called a sovereign debt crisis, and this will be the story of 2023 financially!

What we don’t yet know is how will Bitcoin handle this kind of financial crisis in stocks and real estate? We don’t know that yet. The February FOMC meeting will drop clues as to how low the rate hike will be. 25 bps? Or will it remain at 50 bps? If it is 25 bps, that signals a pause on rate hikes is coming for the 2nd quarter. This seems plausible. However, continued hikes to maintain the dollar milkshake theory is also plausible. We wrote about that in this old blog, click here to read.

We cannot see the future here. In past cycles there was always a pivot, however, this cycle holds circumstances that have never existed before. Thus, all bets are off on Fed policy predictions.

Bitcoin has fared very well for the environment that was in 2022. Investing $1 per day for the year would have resulted in a -34% loss. Better than most portfolios that are aggressive:

That is where Bitcoin can win. It spent the year in a bear market, and it has double bottomed and printed the MACD cross. Per the stock to flow model, 2023 should be much stronger since Bitcoin just printed the dark green circle on the chart, see below:

Also keep in mind that Bitcoin needed to close the year at $17,200 which it fell short of by $500 or so. This was to close the year out, above key support. Now that will be resistance. See this chart below from Steve Courtney:

The double bottom and MACD cross are both positive. However, if rates hikes stay high, this will be tough for Bitcoin to create the demand to break through the $17,200 resistance level. As Michael Burry has stated. If Reverse Repo Agreements are trading below CPI, inflation will not come down for long. Rates being this high creates pressure to lower rates or pause them for a few months. Due to the exhorbidant cost of debt service to the government. If the goal is usher in the BRICS reserve system, which we believe is true, that is the ultimate goal. Then, Bitcoin is part of that as we have revealed in detail in the above referenced blog from last week. Let’s see how all this plays out. This is a financial war we are witnessing. To us, the sooner the US is part of the BRICS reserve currency system the better. Yet, we know this will take a lot of time to come to fruition. We believe, some extra ordinary forces will play their hand in this situation in 2023! The world is changing fast! We are not financial advisors and this is not financial advise. The dollar is in real trouble, and BRICS strengthens by the day with Bitcoin for international settlements. Assuming the Fed will behave as it has in the past appears to be foolhardy. Nothing is as it seems! Bitcoin, Gold and Silver. Those are your options. Crypto Currency is not an option outside of Bitcoin, it’s not decentralized. Oh and for God sakes. Keep your Bitcoin offline.

Good luck, 2023 will be exciting and fast moving. We are not sure yet how this ends

Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.